Directors, reduce your Inheritance Tax

In the first two months of the 2023/24 financial year, HMRC collected a whopping £1.2 billion in Inheritance Tax (IHT) – collecting £600 million in April 2023 alone…

The current IHT threshold is frozen at £325,000 until at least 2028, meaning that where property prices and values increased, particularly over the pandemic, many risk being hit with a higher-than-expected Inheritance Tax bill.

Without implementing an effective tax plan, 40% (on anything above that threshold) of your own wealth will be set to go to HMRC when you pass. As such, formulating an efficient tax planning solution to protect your family’s wealth has never been so important.

As a business owner, there are ways to legally mitigate Inheritance Tax and leave your beneficiaries a tax-free inheritance. By acting on this now and putting the right structure in place, you can mitigate the heavy Inheritance Tax liability, continue to grow your investment portfolio, and build a legacy by securing this for future generations.

Inheritance Tax and the Family Investment Company:

With a Family Investment Company, you can protect your family wealth, hold assets including property, and mitigate tax within HMRC rules. You, the director, maintain control of the Family Investment Company, even with family members as part of the company.

The structure of this set-up allows for a streamlined inheritance process that can achieve 0% Inheritance Tax by holding your assets in a trust, outside of your estate.

Other key benefits include:

- 0% Inheritance tax on existing retained profits

- 0% Corporation tax on investment profits

- Loan funds back to your company

- Invest in property or other asset classes

- Retain and protect business property relief for your trading company

- Create a lifetime-and-beyond legacy

Inheritance Tax and the Small Self-Administered Scheme (SSAS):

The Small Self-Administered Scheme (SSAS) is specifically designed for company directors, by government. It is one of the most flexible and tax-efficient pensions schemes in the UK. In addition to an array of other benefits, a SSAS can have multiple members, including family members. As such, it is an ideal vehicle for succession planning. As a trust, it can be handed down through generations, whilst still letting you take an income in retirement.

If you are looking to keep your business within the family, a SSAS will ensure business continuity is maintained throughout generations as family members leave and join the company.

Other SSAS capabilities:

- purchasing investment property

- making hands-free property investments

- investing in a vast array of other asset classes

- growing your pension fund by investing in property or other asset classes

- making loans to your company for any valid business purpose, from your pension fund

- combining multiple pension funds into one pot for greater investment power, increased choice and more control

- pooling pensions with family or colleagues to increase the pot and grow it more quickly

- succession planning

- retirement planning on your own terms, to your own timescales

- purchasing your business premises and renting them back to the company to grow the pot and remove contract, legal and cost issues by becoming your own landlord

- reducing Corporation Tax

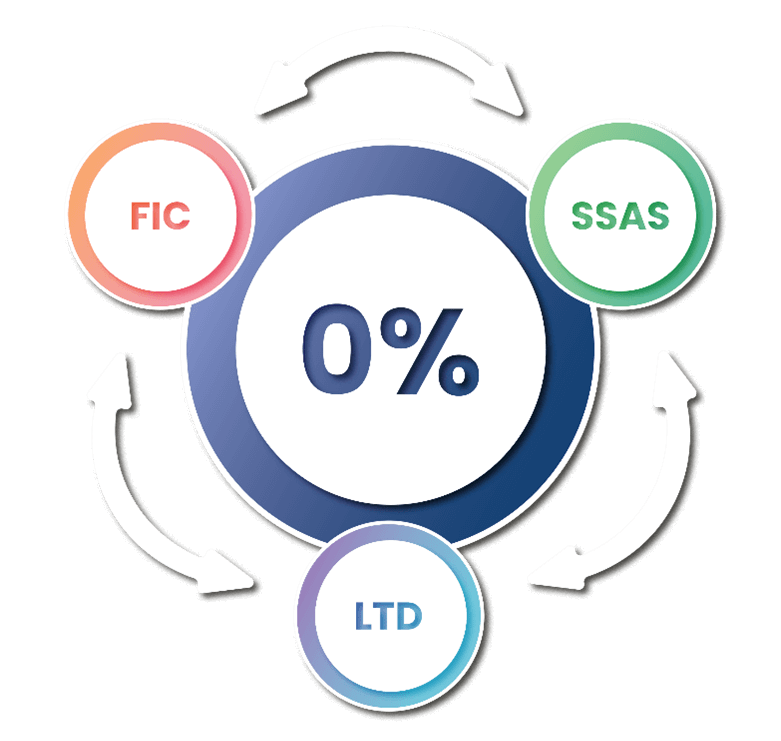

Combining the SSAS and the FIC:

You can combine a Family Investment Company with a Small Self-Administered Scheme. This creates a financial bridge to help create innovative and formidable strategies for yourself and your company. Additionally, it can provide a secure future for your children, whatever the succession plan you have in mind for the business.

In addition to the inheritance tax benefits, combining the tax efficiency of both the Family Investment Company and the Small Self-Administered Scheme (SSAS) you open up further options for diversifying your property investments. Options include:

- Buy-to-let

- Serviced accommodation

- Commercial property

- Residential property

- Land for development

- Purchase of business premises

- Hand-free property investment (suited to those with minimal knowledge of property investment and the laws and regulations surrounding or those looking for minimal time commitment for their property investment strategy)

Plan your business, protect your wealth, and secure your family legacy

Schedule a free 360 planning session

We get 5 stars from our Clients.

Business owners consistently rate us for our expertise, clarity, and genuinely supportive service.

Paul Reid

01.09.2024

I am nearly through the setup process for my SSAS. HMRC have taken about 12 weeks to approve the scheme. TLPI have been quick in getting the SSAS setup process started and have monitored the HMRC approval, responding to questions HMRC asked. TLPI prepared the new bank account application and pension transfer request, ready to submit upon HMRC approval, of the SSAS. Time to complete the setup is as short as possible with TLPIs proactive setup process.

Colin Woodhouse

04.02.2026

Excellent service, held my hand and guided me through the whole SSAS Process. Very pleased with TLPI and their staff who are all very helpful in all respects.

Tina Nguyen

01.05.2025

I had the pleasure of working with Akash Bajij while setting up my Family Investment Company, and I couldn’t recommend him more highly. He’s not only extremely knowledgeable, but also genuinely takes the time to listen and provide thoughtful, tailored advice. Akash guided me through the entire process with clarity and professionalism, making what initially felt complex much more manageable. A truly good guy—honest, approachable, and always willing to help. I’m really grateful for his support and would happily recommend him to anyone looking for expert guidance in this area

Kenneth Irabor

21.08.2024

I am incredibly pleased with the service provided by TLPI in setting up my SSAS pension. The team was professional, knowledgeable, and supportive throughout the entire process. They guided me every step of the way, ensuring that everything was handled smoothly and efficiently. Thanks to their expertise and commitment, I've already seen an initial successful investment, which has given me great confidence in their abilities. I highly recommend TLPI to anyone looking for top-notch support in managing their pension and investments.

Glenn White

01.01.2026

TLPI has been fantastic from start to finish. From my first conversation with Gareth Robertson I had absolute confidence they were the right company for me and my pension assets. After enduring the long HMRC approval process, my SSAS is now fully established and funded, and we are already working on plans to invest and grow it. Gareth and the rest of the team dealt with the entire process extremely professionally, keeping me up to date throughout and responding to my many questions and queries quickly and effectively. I fully recommend TLPI and am looking forward to working with the team for many years to come to maximise my pension assets.

Tommy Meads

19.09.2024

We used Jordan @ TLPI to set up a family trust for our company to purchase a commercial property. He was efficient, informative and professional every step of the way. If there were any queries during the whole process they were resolved promptly. This was our first dealings with family trusts and TLPI's guidance during this time was highly valued! I would highly recommend them!

Preet Singh

01.12.2025

Awesome people, good service and trustable, specially Mr. Akash. Many Thanks

Chris Airey

08.12.2025

It is great to be working with people who want you to win. My key contacts Spencer and Isi know their business - practical and expert.

Liam Thomas

15.08.2024

Jordan looked after us incredibly well from start to finish. Dealing with tax can be a complicated process but Jordan simplfies everything and takes the time to answer all of your questions in detail. Would highley reccomend.

Richard Smith

11.07.2024

TLPI provide a brilliant service full stop. From our initial conversations they have been extremely helpful, diligent and thorough. I can't thank them enough for their advice, pointers and guidance that they have provided so far. They have made something which to me is extremely complex and confusing feel very straight forward.

Cris Emson

29.05.2024

I much appreciate the help and guidance TLPI have given me in setting up a Family Investment Company, and now we have reached the end of the first year we are now preparing the first set of annual accounts. Again TLPI are proving invaluable is giving help and advice, and I am sure none of this would be possible without their expert support.

Keith Jones

17.08.2023

Tlp have been fantastic with there advice and help in setting up my retirement plans , putting structures into place to help with future generational hand over of assets, great advice from Jordan Sharpe, easy to deal with and always on hand for help when needed, well done all, 👏 ✔️

Big thanks to sue for all your outstanding work, sue kept me updated with my pension transfer every step of the way, I would have no problem referring them on to anyone who needs sound advice and financial pension planning, thanks again for all your help,

Vipin Varsani

03.08.2023

Very helpful through the whole process and after.