Trusted by 1k+ Business Directors

The Business SSAS

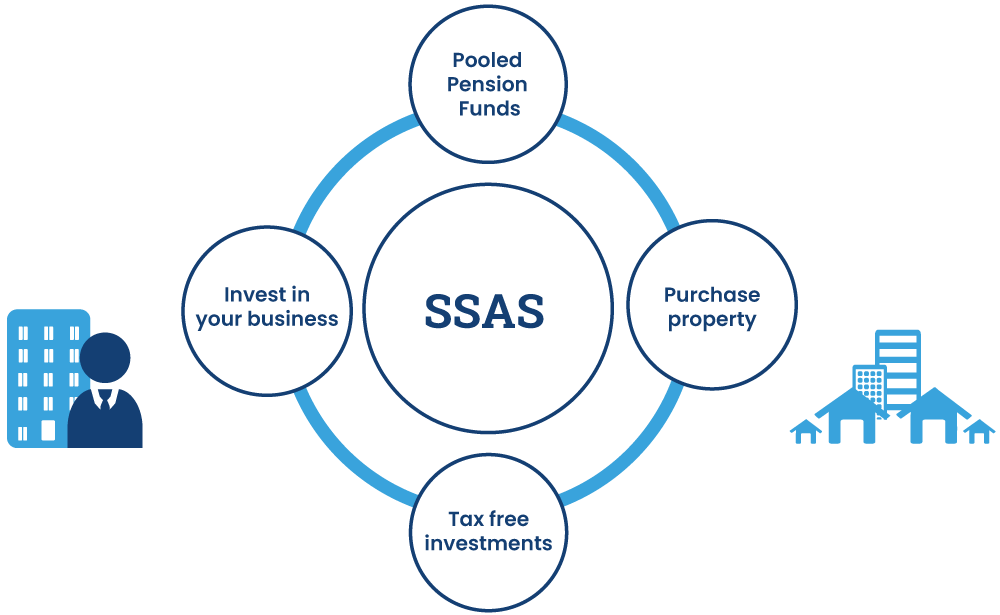

Optimum tax efficiency, business growth and funding. The Business SSAS is a Small Self-Administered scheme (SSAS), established by the director of a trading company. The SSAS is the most flexible UK pension and gives control back, over frozen or dormant workplace and personal pensions.

Speak to a SSAS Expert What is a SSAS pension?

No obligation — Get personalised guidance.

The Business SSAS pension. Innovative strategies for SME businesses providing control, flexibility and optimum tax efficiency.

What is the Business SSAS pension?

The Business SSAS pension is a Small Self-Administered scheme (SSAS), established by the director of a trading company. The SSAS is the most flexible UK pension and gives control back, over frozen or dormant workplace and personal pensions.

Whilst many see pensions as boring, inflexible and inaccessible until after age 55, the Business SSAS pension is the opposite. It is merely a savings and investment account inside a tax efficient wrapper.

Created by government, under HMRC regulations, the Business SSAS allows business owners to align their pensions and their businesses to achieve optimum tax efficiency. In addition to all of the benefits traditional pensions offer, there are extensive tools and advantages such as the ability to loan to your business from your pension, invest in property, loan to a 3rd party, build a legacy, ring-fence and secure assets, save on inheritance tax and much more. Unlike the SIPP, which is a personal pension, the Business SSAS is a corporate pension and so regulated by HMRC and The Pensions Regulator.

A Business SSAS pension scheme can have up to 11 members. These members can be other company employees and/or family members. This offers added advantage as, not only can you combine all of your own pension into one pot, but you can pool pensions with other members, giving greater investment choices and power. All members retain the same percentage portion of the total pot, but as it grows at a faster rate and enjoys extensive tax benefits, each member elevates their own funds.

Why have a Business SSAS?

In addition to the usual tax exemptions available for pensions, a Business SSAS pension offers greater control and flexibility over business and personal assets, when integrated into your strategy. Innovative strategies can be created to grow your business, save tax, and elevate the growth of your retirement fund for yourself and other SSAS members.

For SME businesses, the SSAS is a gamechanger.

Potential strategies that a Business SSAS could employ include:

- Use the SSAS loanback facility to achieve much needed business funding

- The purchase of commercial property. This could include the business premises. Premises can be leased back to the company or a 3rd party

- Rent paid by the company, to the Business SSAS, is an allowed business expense and those funds paid from company to SSAS reduce profit for the year-end tax bill calculation

- Rent received by the SSAS is not liable for income tax

- Profit made upon the sale of the premises is not liable for corporation tax

- You are able to make a loan from your Business SSAS pension, to your company, providing essential cashflow

- A loan from your SSAS to your company could be used to purchase property or for the development of property

- You could use your SSAS to buy an equity stake in the company, providing cashflow

- Limited company investment options are extensive. As a company, you are able to start a SSAS pension and invest in a vast array of asset classes.

- Fees are not dependent on fund size, so consolidation of funds is possible for easier management, greater growth and control

A source of finance

The ‘loanback’ is a unique feature of the business SSAS pension that many SME directors are often unaware exists. It offers the ability to make a business loan of up to 50% of the value of your pension to your company, for any valid business purpose. For example, you could use the funds in your pension for stock acquisition in your company, or if needed, a simple capital injection.

Doing so saves approaching the banks, waiting for decisions and the fees and charges experienced

A strategy for increased tax efficiency and growth

The loanback must be paid back to the Business SSAS pension with an interest rate sat at a minimum of 1% above the current market base rate. For some, this is ideal as a cheap loan when the company needs it. For others however, a strategy of setting the interest rate much higher means that company payments to the SSAS are an allowed business expense, year-end profits and thus, tax, is reduced, the SSAS receives the payments without liability for income tax and this can be repeated once the loan is paid back, using 50% of a now increased pot.

Essentially, the loanback facility is an interest free strategy, as all funds are retained either by the company or by the Business SSAS.

For family businesses

The advantages of a Business SSAS pension for family businesses are vast. In addition to the above business and retirement fund growth and control, a SSAS can protect family assets and ensure business continuity as generations move through the business. The SSAS facilitates straight-forward exit strategies as company members retire. A SSAS is a family asset that can be handed on and continued for many years. This is covered in more detail in our Family SSAS pension section.

Want your questions answered by our expert SSAS and investment consultants?

Book your free, 15 minute no obligation call to find out more!

We get 5 stars from our Clients.

Business owners consistently rate us for our expertise, clarity, and genuinely supportive service.

Paul Reid

I am nearly through the setup process for my SSAS. HMRC have taken about 12 weeks to approve the scheme. TLPI have been quick in getting the SSAS setup process started and have monitored the HMRC approval, responding to questions HMRC asked. TLPI prepared the new bank account application and pension transfer request, ready to submit upon HMRC approval, of the SSAS. Time to complete the setup is as short as possible with TLPIs proactive setup process.

Colin Woodhouse

Excellent service, held my hand and guided me through the whole SSAS Process. Very pleased with TLPI and their staff who are all very helpful in all respects.

Tina Nguyen

I had the pleasure of working with Akash Bajij while setting up my Family Investment Company, and I couldn’t recommend him more highly. He’s not only extremely knowledgeable, but also genuinely takes the time to listen and provide thoughtful, tailored advice. Akash guided me through the entire process with clarity and professionalism, making what initially felt complex much more manageable. A truly good guy—honest, approachable, and always willing to help. I’m really grateful for his support and would happily recommend him to anyone looking for expert guidance in this area

Kenneth Irabor

I am incredibly pleased with the service provided by TLPI in setting up my SSAS pension. The team was professional, knowledgeable, and supportive throughout the entire process. They guided me every step of the way, ensuring that everything was handled smoothly and efficiently. Thanks to their expertise and commitment, I've already seen an initial successful investment, which has given me great confidence in their abilities. I highly recommend TLPI to anyone looking for top-notch support in managing their pension and investments.

Glenn White

TLPI has been fantastic from start to finish. From my first conversation with Gareth Robertson I had absolute confidence they were the right company for me and my pension assets. After enduring the long HMRC approval process, my SSAS is now fully established and funded, and we are already working on plans to invest and grow it. Gareth and the rest of the team dealt with the entire process extremely professionally, keeping me up to date throughout and responding to my many questions and queries quickly and effectively. I fully recommend TLPI and am looking forward to working with the team for many years to come to maximise my pension assets.

Tommy Meads

We used Jordan @ TLPI to set up a family trust for our company to purchase a commercial property. He was efficient, informative and professional every step of the way. If there were any queries during the whole process they were resolved promptly. This was our first dealings with family trusts and TLPI's guidance during this time was highly valued! I would highly recommend them!

Preet Singh

Awesome people, good service and trustable, specially Mr. Akash. Many Thanks

Chris Airey

It is great to be working with people who want you to win. My key contacts Spencer and Isi know their business - practical and expert.

Liam Thomas

Jordan looked after us incredibly well from start to finish. Dealing with tax can be a complicated process but Jordan simplfies everything and takes the time to answer all of your questions in detail. Would highley reccomend.

Richard Smith

TLPI provide a brilliant service full stop. From our initial conversations they have been extremely helpful, diligent and thorough. I can't thank them enough for their advice, pointers and guidance that they have provided so far. They have made something which to me is extremely complex and confusing feel very straight forward.

Cris Emson

I much appreciate the help and guidance TLPI have given me in setting up a Family Investment Company, and now we have reached the end of the first year we are now preparing the first set of annual accounts. Again TLPI are proving invaluable is giving help and advice, and I am sure none of this would be possible without their expert support.

Keith Jones

Tlp have been fantastic with there advice and help in setting up my retirement plans , putting structures into place to help with future generational hand over of assets, great advice from Jordan Sharpe, easy to deal with and always on hand for help when needed, well done all, 👏 ✔️

Big thanks to sue for all your outstanding work, sue kept me updated with my pension transfer every step of the way, I would have no problem referring them on to anyone who needs sound advice and financial pension planning, thanks again for all your help,

Vipin Varsani

Very helpful through the whole process and after.