TLPI SSAS Value Difference

A Small Self-Administered Scheme (SSAS) remains one of the most powerful pension tools for company directors to grow their business and create lasting wealth. Its versatility is unmatched, but the landscape of pensions and tax legislation is constantly evolving.

To protect yourself and maximise your SSAS’s potential, choosing the right level of support is crucial.

Comparing your Options: Beyond the Basics

When choosing SSAS support, consider these fundamental principles:

Growing family wealth Is your chosen provider equipped to develop strategies that truly maximize your wealth over generations?

Supporting your trading company Can they help you leverage your SSAS to fuel your business growth?

Maximising tax-efficiency Do they have the expertise to optimise your tax position, for both your personal and business goals?

Expanding investment opportunities Can they offer access to a diverse range of investments tailored to your specific goals?

Protecting your legacy Are they committed to ensuring your SSAS benefits future generations?

Achieving your desired retirement Will they help you create a plan that secures the retirement you envision?

Navigating the legal complexities, administrative burdens, and investment strategy requires in-depth support and specialist knowledge to ensure your scheme has long-term success.

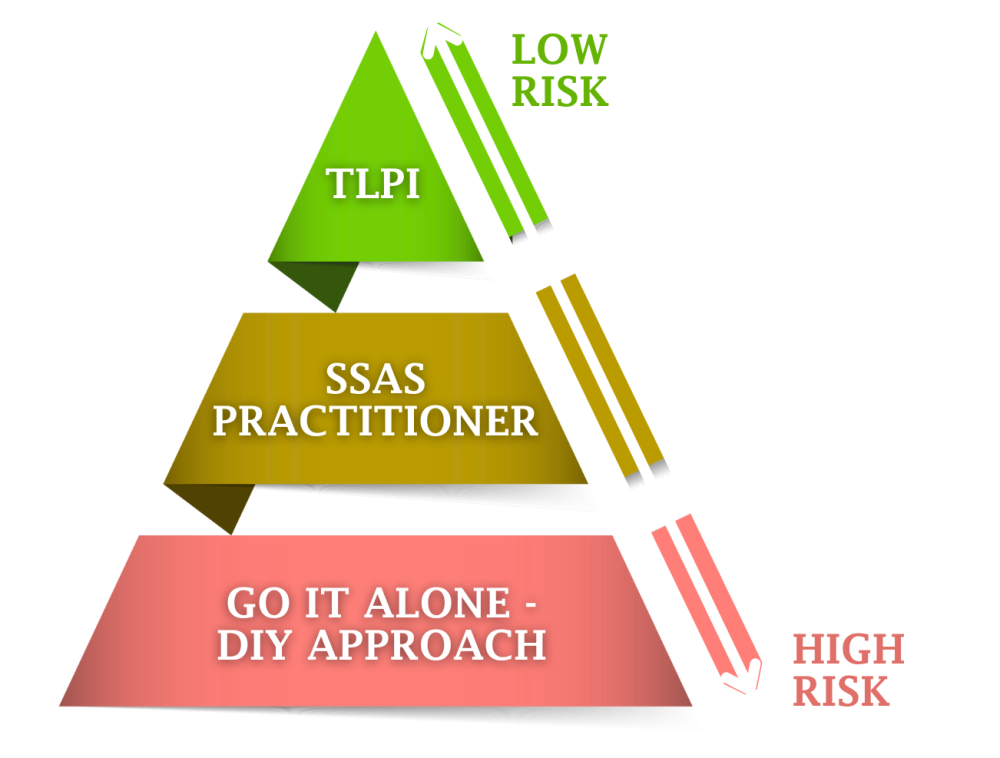

You have several options:

- Opting for TLPI’s full SSAS service

- Engaging a SSAS Practitioner

- Going it alone – DIY approach

While the DIY approach might seem appealing, remember that you will be solely responsible for all aspects of setup, management, administration, and compliance – a potentially high-risk endeavour.

You have complete control over who manages your SSAS. While a SSAS Practitioner might seem like a cost-effective option initially, remember that they may not be responsible for ongoing compliance or offer proactive strategic advice.

TLPI’s full SSAS service package provides everything a SSAS Practitioner offers, plus investment and pension strategy, ongoing periodical SSAS reviews, and dedicated support.

A successful SSAS demands correct setup, ongoing compliance, and a carefully structured investment strategy.

TLPI Makes it Easy

The key to a successful SSAS lies in minimising risk while maximising long-term returns.

This requires meticulous due diligence and a tailored, bespoke strategy – which is exactly what we offer our clients at TLPI. We make having a SSAS easy and give our clients peace of mind through our expert guidance and support.

Our SSAS services stand out from other practitioners due to our comprehensive and strategic approach to pension management. We prioritise understanding your unique situation as the foundation for every SSAS setup and management plan.

With TLPI, you benefit from a lifetime SSAS service that includes complete setup, pension transfers, tax and investment planning, legal compliance and ongoing support to ensure the continued success of your SSAS.

Our team of SSAS experts provides exemplary setup, strategy, and investment support, making the entire process straightforward and stress-free for our clients.

Here are our key differentiators:

1

All-in-one Service

Unlike basic SSAS practitioners who may offer limited services, TLPI provides a complete package that covers everything from initial setup and ongoing investment, to legal compliance and pension strategy.

2

Proactive Management

At TLPI, we do not just react to events; we anticipate them. Our service includes ongoing, periodical SSAS reviews to ensure your scheme remains aligned with your goals and compliant with changing regulation.

3

Expertise in Wealth Creation

TLPI focuses on growing family wealth and supporting trading companies. We develop strategies to maximise wealth over generations and help leverage SSAS to fuel business growth.

4

Tax Optimisation

TLPI has the expertise to minimise tax liabilities, both for personal and business goals, which is crucial for maximising the benefits of a SSAS.

5

Investment Diversification

TLPI offers access to a diverse range of investments tailored to specific client goals and expanding investment opportunities beyond what basic practitioners might provide.

6

Long-Term Planning

TLPI is committed to helping clients achieve their desired retirement and protect their legacy, ensuring SSAS benefits extend to future generations.

7

Minimising Risk

TLPI prioritises meticulous due diligence and tailored strategies to minimise risk while maximising long-term returns.

8

Dedicated Support

Clients receive personalised guidance from a dedicated team of experts, providing a level of support that may not be available with basic SSAS practitioners.

9

Focus on Legal Compliance

TLPI ensures ongoing legal compliance with regulations, which is crucial given the significant control and responsibility entrusted to SSAS members.

10

Strategic Partnership

At TLPI, we position ourself as a strategic partner committed to helping our clients grow their business and maximise wealth, rather than just an administrator.

Without a robust and continuously refined strategy that is aligned with your business and pension goals, your SSAS will not reach its full potential. An ongoing strategy is integral to the success of any SSAS scheme.

Transforming Futures: Why TLPI Stands Out

Do not just take our word for it.

See how real business owners, just like you, have taken control of their financial futures and unlocked the immense power of a SSAS pension with TLPI’s expert guidance.

Our clients are achieving remarkable results, from expanding their property portfolios to fuelling business growth and creating lasting legacies.

From Business Growth to Smart Investments

Mags Kirk sought investment opportunities to manage her company’s increased profits following a successful expansion. Mags chose TLPI for a straightforward introduction to property investment via a SSAS, valuing their trustworthy guidance.

TLPI provided a clear explanation of the SSAS benefits and process, and Mags made her first investment into property to achieve fixed returns with a comfortable level of risk.

As a result, just four months into her SSAS and property investment journey, she is arranging further consultations with experts at TLPI to look at additional investment opportunities as her funds continue to grow.

Mags was able to confidently invest, gain a trustworthy advisor and is in a position to bring her partner into the SSAS and pool pensions.

TLPI’s responsive, friendly, and genuine service made the process easy and successful.

From Property Portfolio to SSAS Success

Paul and Annie Allen, despite owning a substantial property portfolio, were concerned about tax implications. Previous advice on SSAS pensions left them unsure, and they were wary of scams.

With TLPI’s support, the Allens established a SSAS, allowing them to consolidate assets, secure their legacy, and invest in new opportunities like small loans to developers, all while enjoying tax efficiency.

TLPI handled the transfers and paperwork seamlessly, giving both Paul and Annie peace of mind their SSAS was compliant in all areas.

Paul and Annie gained financial control, and the ability to shape their legacy whilst adapting to changing business landscapes, positioning them for continued growth and tax efficiency.

TLPI provided clear, down-to-earth practical advice, dispelling jargon and alleviating their concerns.

From Limited Pensions to Unlimited Growth

Steve, a property-focused business owner, felt restricted by traditional pensions’ lack of control and access, hindering his company’s growth. Discovering the SSAS pension’s flexibility, particularly its loanback feature, he sought expert guidance and chose TLPI based on their expertise and 5-star reviews.

TLPI helped Steve set up a SSAS, enabling his company to borrow funds and purchase a buy-to-let property for cash. Steve achieved his initial goal quickly, expanded his portfolio, diversified his investments, and gained control over his pension, securing his family’s future.

TLPI’s expert knowledge, practical advice, and smooth process empowered Steve to unlock his pension’s potential, grow his business, and create a robust long-term investment strategy, all while eliminating the uncertainties of traditional pensions.

TLPI unlocked the full potential of the SSAS by leveraging expert knowledge to create robust investment strategies

Need specific pension investment advice?

Want your questions answered by our expert SSAS and investment consultants?

Book your free, 15 minute no obligation call to find out more!

We get 5 stars from our Clients.

Business owners consistently rate us for our expertise, clarity, and genuinely supportive service.

Paul Reid

I am nearly through the setup process for my SSAS. HMRC have taken about 12 weeks to approve the scheme. TLPI have been quick in getting the SSAS setup process started and have monitored the HMRC approval, responding to questions HMRC asked. TLPI prepared the new bank account application and pension transfer request, ready to submit upon HMRC approval, of the SSAS. Time to complete the setup is as short as possible with TLPIs proactive setup process.

Colin Woodhouse

Excellent service, held my hand and guided me through the whole SSAS Process. Very pleased with TLPI and their staff who are all very helpful in all respects.

Tina Nguyen

I had the pleasure of working with Akash Bajij while setting up my Family Investment Company, and I couldn’t recommend him more highly. He’s not only extremely knowledgeable, but also genuinely takes the time to listen and provide thoughtful, tailored advice. Akash guided me through the entire process with clarity and professionalism, making what initially felt complex much more manageable. A truly good guy—honest, approachable, and always willing to help. I’m really grateful for his support and would happily recommend him to anyone looking for expert guidance in this area

Kenneth Irabor

I am incredibly pleased with the service provided by TLPI in setting up my SSAS pension. The team was professional, knowledgeable, and supportive throughout the entire process. They guided me every step of the way, ensuring that everything was handled smoothly and efficiently. Thanks to their expertise and commitment, I've already seen an initial successful investment, which has given me great confidence in their abilities. I highly recommend TLPI to anyone looking for top-notch support in managing their pension and investments.

Glenn White

TLPI has been fantastic from start to finish. From my first conversation with Gareth Robertson I had absolute confidence they were the right company for me and my pension assets. After enduring the long HMRC approval process, my SSAS is now fully established and funded, and we are already working on plans to invest and grow it. Gareth and the rest of the team dealt with the entire process extremely professionally, keeping me up to date throughout and responding to my many questions and queries quickly and effectively. I fully recommend TLPI and am looking forward to working with the team for many years to come to maximise my pension assets.

Tommy Meads

We used Jordan @ TLPI to set up a family trust for our company to purchase a commercial property. He was efficient, informative and professional every step of the way. If there were any queries during the whole process they were resolved promptly. This was our first dealings with family trusts and TLPI's guidance during this time was highly valued! I would highly recommend them!

Preet Singh

Awesome people, good service and trustable, specially Mr. Akash. Many Thanks

Chris Airey

It is great to be working with people who want you to win. My key contacts Spencer and Isi know their business - practical and expert.

Liam Thomas

Jordan looked after us incredibly well from start to finish. Dealing with tax can be a complicated process but Jordan simplfies everything and takes the time to answer all of your questions in detail. Would highley reccomend.

Richard Smith

TLPI provide a brilliant service full stop. From our initial conversations they have been extremely helpful, diligent and thorough. I can't thank them enough for their advice, pointers and guidance that they have provided so far. They have made something which to me is extremely complex and confusing feel very straight forward.

Cris Emson

I much appreciate the help and guidance TLPI have given me in setting up a Family Investment Company, and now we have reached the end of the first year we are now preparing the first set of annual accounts. Again TLPI are proving invaluable is giving help and advice, and I am sure none of this would be possible without their expert support.

Keith Jones

Tlp have been fantastic with there advice and help in setting up my retirement plans , putting structures into place to help with future generational hand over of assets, great advice from Jordan Sharpe, easy to deal with and always on hand for help when needed, well done all, 👏 ✔️

Big thanks to sue for all your outstanding work, sue kept me updated with my pension transfer every step of the way, I would have no problem referring them on to anyone who needs sound advice and financial pension planning, thanks again for all your help,

Vipin Varsani

Very helpful through the whole process and after.

Want your questions answered by our expert SSAS and investment consultants?

Book your free, 15 minute no obligation call to find out more!